Assessor

Assessor

The Assessor does not determine tax rates or collect taxes. For information regarding TAXES please call the TAX COLLECTOR. You can view or print your tax bill by following this LINK.

See office hours in the Current Assessor Info tab, below.

From the Assessor

It is Exemption Season! Renewal notices have been sent out for Low Income Seniors, Disabled and Agricultural Assessments.

Please read the instructions. Do not delay, get your paperwork in today!

NO EXEMPTIONS WILL BE ACCEPTED AFTER MARCH 1!!

Remember, Enhanced STAR does not need a renewal unless you get a letter from the State! If you do get a letter from the State, you must reply to the State, not the Assessor. If you are signing up for any Exemption for the first time, you can find forms and information on both the Assessors page of our website and in the Town Hall.

Grievance Day Information

Grievance day will be held at the Town Hall, 14577 Route 22, New Lebanon between the hours of 1-4 and 5-8 on May 29, 2024

The Board of Assessment Review is a public meeting held once a year in the Meeting room located in the New Lebanon Town Hall.

Complaint forms can be accepted up until the close of the meeting. However, to avoid an adjournment forms should be submitted 3 days prior to Grievance Day to allow time for the Assessor to review. Forms can be mailed, emailed or dropped off at the Town Hall.

Grievance Form and Instructions - must be filled out to file a complaint

Grievance Form

Sales Worksheet (not required, but provided for your convenience)

Complaint forms can be accepted up until the close of the meeting. You may appear in person but it is not required.

Mail or drop off two (2) copies of your forms at the Town Hall.

To avoid an adjournment, forms should be submitted 3 days prior to Grievance Day to allow time for the Assessor to review.

You must use a separate form for each parcel

You must state your determination of value (what you believe your assessment should be) on line 7.

Helpful hints

Provide supporting information that supports your determination of value.

- Provide photos

- Provide sales of similar properties, appraisal or Realtor Comparative Market analysis

- Do not discuss “tax implications” or “percentage increase”.

- Grievance complaints are to be based on your MARKET VALUE as of July 1, 2023.

- If you are not appearing in person, it is suggested that you include a cover letter with a summary of your complaint

IN PERSON NOTES –. A copy of your form and documentation should be submitted at least 3 days prior to the meeting (May 23rd). The Assessor will need time to review and respond to Board of Assessment questions. Walk-ins that have not pre-submitted their information are subject to an adjournment. NO appointments. First come first serve basis. 10 minutes per parcel

Who am I / Contact

Kimberly Smith

email: assessor@townofnewlebanon.com

phone: 518-794-8875

FAX: 518-794-9694

Fastest and easiest way to contact the assessor is via email.

Quick Links

Exemptions

RENEWALS are sent the first week in December.

ALL APPLICATIONS ARE DUE NO LATER THAN MARCH 1. LATE APPLICATIONS WILL BE DENIED.

Star Program, including new Taxpayer Star Flow Chart

If you’ve recently bought your home or you’ve never applied for the STAR benefit on your current home, you may be able to save hundreds of dollars each year. You only need to register for the STAR credit once, and you’ll continue to receive the annual benefit as long as you’re eligible. Register Below!

Switching from the exemption to the credit? Register below! You may receive a greater benefit.

Enhanced Star Renewals

The Tax Department will annually review applicants’ income to determine their eligibility for the Enhanced STAR exemption. You do not need to reapply with the Assessor. If additional information is needed, the department will contact the property owner directly. For Enhanced Star questions call 518-457-2036.

Changing from Basic STAR to Enhanced STAR. If you currently have Basic STAR on your tax bill and are turning 65 years old with an adjusted gross income of less than $107,300 you may be eligible for Enhanced STAR. For this you WILL apply with the Assessor. Please call 518-794-8875 to have these forms mailed to you.

See the chart below for more info. All forms are in the following tab, marked “Exemption forms”

Exemption Forms

- Agricultural Assessment Exemption: RP-305 (new Ag), RP-305-R (renewals) –

- Soils Group Worksheets can be obtained at Columbia County Soil and Water District (518) 828-4386 x 3

- Enhanced Star form: RP425ivp

- Low Income Disabled Exemption:RP-459-c (new applicants), RP-459-C-Rnw (renewals)

- This provides for an exemption in the amount of between 5% and 50% depending on Income.

- The current Income Limit for the Town and County is between $34,000 for a 50% exemption and $42,399 for a 5% exemption.

- Income includes all Social Security. All owners and their Spouses income is included.

- Low Income Senior Exemption: RP-467 (new applicants), RP-467-Rnw (for renewals)

- This provides for an exemption in the amount of between 5% and 50% depending on Income.

- The current Income Limit for the Town and County is between $34,000 for a 50% exemption and $42,399 for a 5% exemption.

- Income includes all Social Security. All owners and their Spouses income is included.

- You MUST include a copy of your prior year Federal Tax Return. If you do not file a return you MUST fill out an Income Worksheet.

- Alternative Veteran’s Exemption: (RP-458-a)

- Cold War Veteran’s Exemption (RP-458-b)

- Volunteer Firefighters and Ambulance workers – (RP-466-a)

- Non Profit Exemptions: See this Page of the Assessor’s Manual for details and a list of necessary forms for new applicants and for renewals.

- Forest exemptions

For exemption renewals, applicants will be mailed or a renewal form around December 1st. If you do not receive a form by the end of December, please contact the A

New Lebanon Assessment Rolls

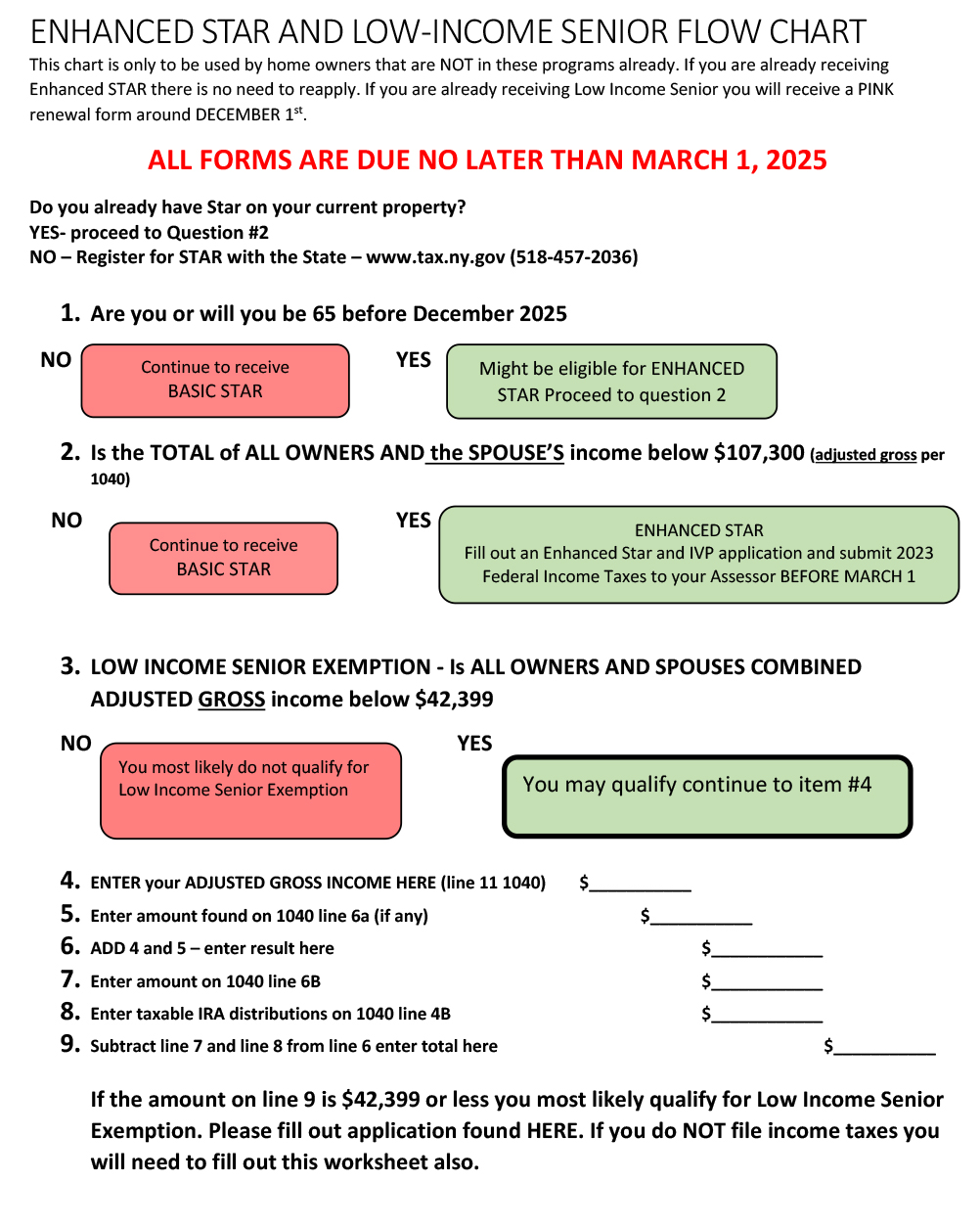

ENHANCED STAR AND LOW-INCOME SENIOR FLOW CHART

This chart is only to be used by homeowners that are NOT in these programs already. If you are already receiving Enhanced STAR, there is no need to reapply. If you are already receiving Low Income Senior, you will receive a PINK renewal form around December 1.

ALL FORMS ARE DUE NO LATER THAN MARCH 1, 2025

Do you already have Star on your current property?

YES – proceed to Question #2

NO – Register for STAR with the State – www.tax.ny.gov (518-457-2036)

1. Are you or will you be 65 before December 2025?

NO

Continue to receive BASIC STAR

YES

Might be eligible for ENHANCED STAR. Proceed to Question 2

2. Is the TOTAL of ALL OWNERS AND the SPOUSE’S income below $107,300 (adjusted gross per 1040)

NO

Continue to receive BASIC STAR

YES

ENHANCED STAR

Fill out an Enhanced Star and IVP application and submit 2023 Federal Income Taxes to your Assessor BEFORE MARCH 1.

3. LOW INCOME SENIOR EXEMPTION – Is ALL OWNERS AND SPOUSES COMBINED ADJUSTED GROSS income below $42,399?

NO

You most likely do not qualify for Low Income Senior Exemption

YES

You may qualify – continue to item #4

If the amount on line 9 is $42,399 or less, you most likely qualify for the Low Income Senior Exemption. Please fill out the application found HERE. If you do NOT file income taxes, you will need to fill out this worksheet also.